Options is a financial contract that gives you the right, but not the obligation, to buy or sell an asset (like a stock) at a specific price, within a certain time period.

Table of Contents

What Is Options?

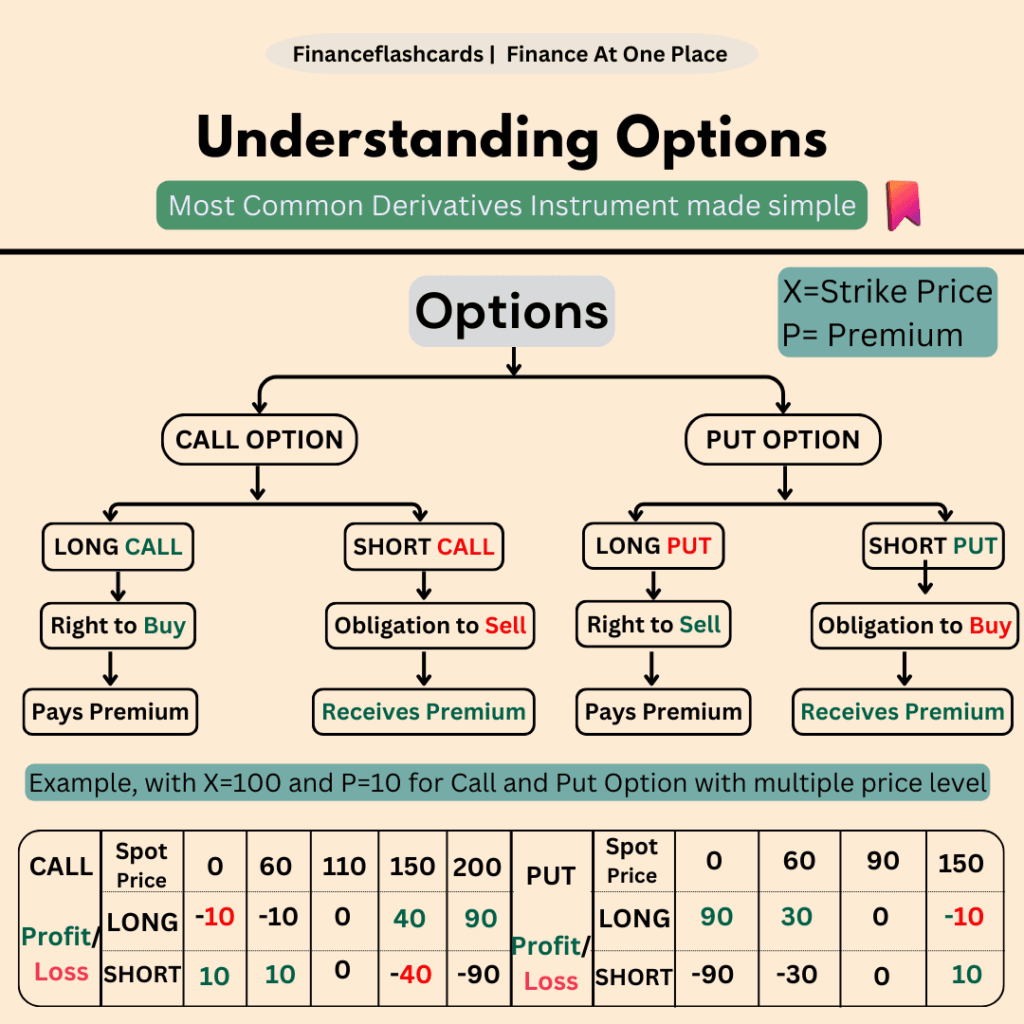

Understanding Options

Types Of Options

Puts

A put option gives the buyer the right (but not the obligation) to sell 100 shares at a

specified price (the exercise price, also referred to as the strike price) for specified

period of time, the time to expiration.

Example of a Put Option:

Imagine you own shares of a company currently trading at $100 per share. You buy a put option that gives you the right to sell those shares at $95 each within the next month for a premium of $5.

- If the stock price falls to $85, you can still sell your shares for $95, making a profit (you sell for $95, buy at $85, minus the $5 premium cost).

- If the stock price stays above $95, you don’t use the option and simply let it expire, losing only the premium paid ($5).

This is how a put option helps protect against a decline in the asset’s price.

Calls

specified price (the exercise price) for a specified period of time. The call seller

(writer) takes on the obligation to sell the 100 shares at the exercise price, if the call

buyer exercises the option.

Example of a Call Option:

Suppose a stock is currently trading at $50 per share. You buy a call option with a strike price of $55, which gives you the right to buy the stock at $55 within the next month, for a premium of $3.

- If the stock price rises to $65, you can exercise the option to buy at $55, then sell at $65, making a profit of $10 per share (minus the $3 premium you paid).

- If the stock price stays below $55, you would not exercise the option, and you lose the premium ($3).

This is how a call option allows you to potentially profit from an increase in the asset’s price while limiting your risk to the premium paid.

American versus European Options

The main distinction between American and European options is when they can be exercised:

American Options: American options may be exercised at any time before or after the expiration date. This allows the holder to take advantage of favorable price movements for the duration of the option.

European Options: European options can only be exercised on their expiration date. While they have similar characteristics to American options, the limited exercise window can limit the holder’s ability to profit from short-term price fluctuations.

Both types can be called or put, but the difference is in the exercise timing, and it has nothing to do with geography.

How Do Options Work?

Options are classified as call options, which allow buyers to profit if the stock price rises, and put options, which allow buyers to profit when the stock price falls.

Investors can also short an option by selling it to another investor. Shorting (or selling) a call option means profiting if the underlying stock falls, whereas selling a put option means profiting if the stock rises in value.