When you read a company’s quarterly results, the first number you usually notice is revenue. The second is net profit.

But serious investors look at something deeper — operating margin.

Why? Because operating margin tells you how strong the core business really is. It shows whether a company is efficient, competitive, and able to control costs — even before interest and taxes come into the picture.

If you are analyzing Indian stocks like Tata Consultancy Services, Infosys, or Hindustan Unilever Limited, understanding operating margin can completely change how you read financial statements.

Let’s break it down in simple, practical language.

What Is Operating Margin?

Operating margin is the percentage of revenue a company keeps after paying for its operating expenses.

Operating expenses include:

Employee salaries

Raw materials

Rent and utilities

Marketing and advertising

Administrative expenses

It does not include:

Interest on loans

Taxes

One-time gains or losses

In simple words:

Operating margin shows how profitable a company’s core business operations are.

It answers a powerful question:

For every ₹100 the company earns, how much is left after running the business?

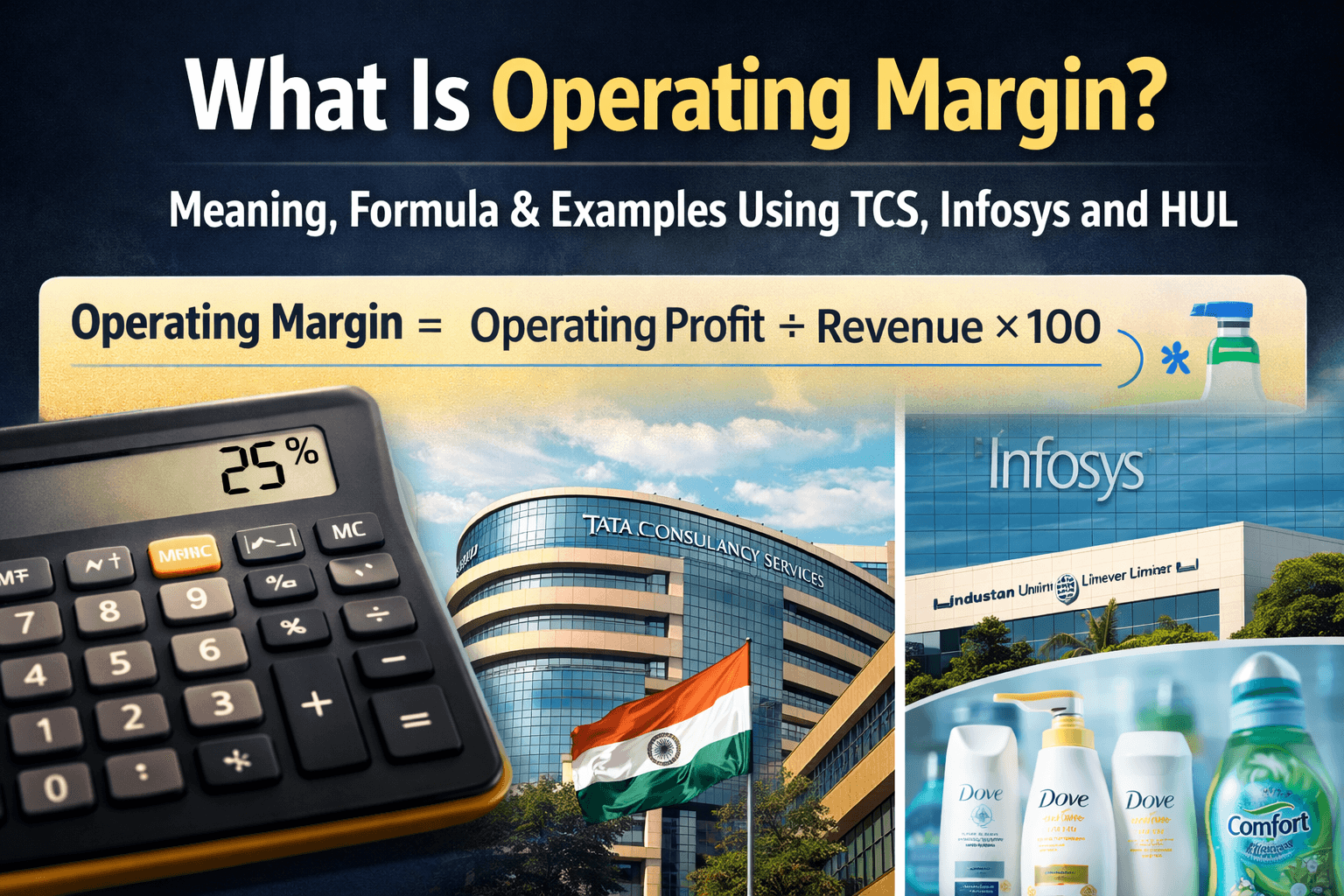

Operating Margin Formula (Simple Explanation)

The formula is straightforward:

Operating Margin = (Operating Profit ÷ Revenue) × 100

Where:

Operating Profit = Revenue – Operating Expenses

Revenue = Total sales generated by the company

Example:

If a company earns ₹1,000 crore in revenue and keeps ₹250 crore as operating profit:

Operating Margin = (250 ÷ 1000) × 100 = 25%

That means the company keeps ₹25 out of every ₹100 it earns — before paying interest and taxes.

Why Operating Margin Is Important for Investors

Operating margin is one of the most important profitability ratios in stock analysis.

Here’s why:

1. It Shows Business Efficiency

Higher margins usually mean better cost control and operational discipline.

2. It Reflects Pricing Power

Companies with strong brands can charge premium prices and protect margins.

3. It Signals Competitive Strength

Stable or rising margins over time often indicate a durable business model.

4. It Helps Compare Companies

Margin comparison works best within the same sector.

For example, comparing TCS and Infosys makes sense. Comparing TCS with HUL directly does not — because industries differ.

Operating Margin Example: TCS

Tata Consultancy Services operates in the IT services sector.

In IT companies:

Employee cost is the biggest expense

There is minimal raw material cost

Businesses are asset-light

IT firms typically enjoy higher operating margins compared to manufacturing businesses.

TCS maintains strong margins due to:

Large offshore delivery model

Efficient workforce utilisation

Long-term global client contracts

High-value digital and consulting services

In IT, even small margin movements matter. A 1% change can significantly impact profits.

Operating Margin Example: Infosys

Infosys operates in the same industry as TCS.

When analysts compare Infosys and TCS, operating margin is a key metric.

If Infosys reports:

Lower margins → It may signal pricing pressure or lower employee utilization.

Higher margins → It may reflect cost control or better deal quality.

In IT services, utilization rate (percentage of employees billing clients) directly affects operating margin.

That is why margin commentary in earnings calls is closely tracked by investors.

Operating Margin Example: HUL

Now let’s look at a different sector.

Hindustan Unilever Limited operates in FMCG (Fast-Moving Consumer Goods).

Here, costs look very different:

Raw materials (like palm oil and packaging)

Advertising and branding

Distribution and logistics

FMCG companies usually have:

Stable but competitive margins

Exposure to commodity price fluctuations

Strong dependence on pricing power

Unlike IT companies, FMCG firms deal with physical supply chains and raw material volatility.

That’s why operating margins vary by industry.

What Is a Good Operating Margin?

There is no single “good” operating margin number.

It depends on the sector:

IT services → Generally higher margins

FMCG → Moderate but stable margins

Manufacturing → Lower margins due to high input costs

Retail → Thin margins

The real indicator of strength is consistency.

A company with stable margins over 5–10 years is usually more reliable than one with fluctuating profitability.

Operating Margin vs Net Profit Margin

Many beginners confuse these two.

Here’s the difference:

Operating Margin = Profit from core business operations

Net Profit Margin = Final profit after interest, tax, and all expenses

Operating margin shows how strong the business model is.

Net margin reflects overall financial structure.

For long-term investors, operating margin often gives earlier warning signals.

Why Operating Margins Change

Margins improve when:

Costs are controlled

Efficiency improves

Automation increases productivity

Companies raise prices

Margins decline when:

Raw material prices rise

Wage costs increase

Demand weakens

Competitive pricing pressure intensifies

That’s why tracking margin trends across quarters is critical.

How to Use Operating Margin in Stock Analysis

Here is a practical checklist:

✔ Compare margins with industry peers

✔ Check 5-year historical margin trends

✔ Read management commentary on margins

✔ Watch for sudden margin expansion or contraction

✔ Ensure revenue growth is supported by stable margins

If revenue rises but margins fall sharply, profitability may not sustain.

Final Takeaway

Operating margin is one of the most powerful financial ratios for investors.

It tells you:

How efficient a company is

How strong its pricing power is

How resilient its business model is

Whether you are analysing IT giants like TCS and Infosys or FMCG leaders like HUL, operating margin gives you clarity beyond headline revenue numbers.

Before investing in any stock, don’t just ask:

“How fast is revenue growing?”

Ask a better question:

How much of that revenue actually turns into operating profit?

That’s where intelligent investing begins.